When we talk about financial security, the first thing that comes to mind is stability in old age. But the truth is, millions of people in India—especially farmers, unorganized workers, and small traders—do not have any pension scheme or savings to depend on once they stop working. For them, old age often means struggling for survival, depending on children, or even living without proper food and medical care. The Government of India recognized this pain and came forward with a beautiful initiative: Maandhan Yojna.

Imagine a scheme where you can live your retirement life with dignity. Imagine not having to stretch your hands in front of anyone for basic needs. Imagine a monthly pension of ₹3000—small for some, but a lifeline for millions. That is what the Maandhan Yojna offers. This blog post will take you through every aspect of this scheme, why it is so important, who can benefit, and how you can apply.

What is Maandhan Yojna?

The Maandhan Yojna is an umbrella pension scheme launched by the Government of India to provide social security to the most vulnerable groups of society. It ensures that senior citizens from the unorganized sector, small and marginal farmers, and traders get a monthly pension of ₹3000 after reaching the age of 60.

This is not just a government scheme—it is a promise of security, dignity, and hope for those who spend their lives working tirelessly but without formal retirement benefits.

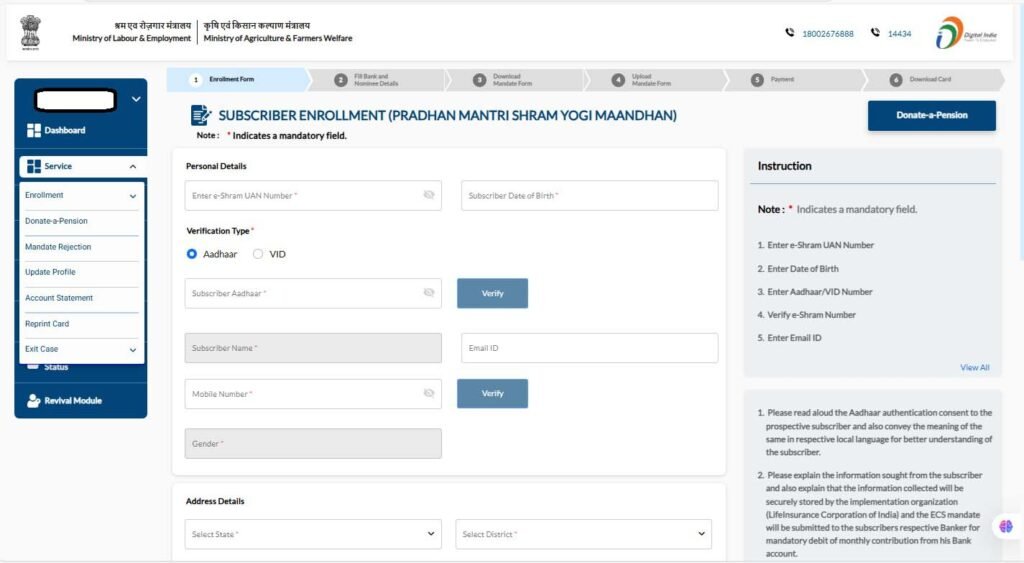

The portal lets you apply for yourself, or you can reach out to CSC Operators to apply for the Maandhan Yojana

Why is Maandhan Yojna So Important?

In India, more than 90% of the workforce belongs to the unorganized sector. These include farmers, street vendors, rickshaw pullers, shopkeepers, construction workers, and many more. Most of them earn daily and do not have access to retirement planning or savings accounts.

For them, old age is often filled with fear and uncertainty. The Maandhan Yojna gives them a chance to dream of a secure future. A pension of ₹3000 may not sound huge to some, but for a poor farmer or a street vendor, it means food on the table, medicines when needed, and independence from begging or relying on others.

Who Can Benefit From Maandhan Yojna?

The Maandhan Yojna is designed for:

- Pradhan Mantri Shram Yogi Maandhan Yojna (PM-SYM): For unorganized sector workers like domestic helpers, drivers, street vendors, and others earning less than ₹15,000 per month.

- Pradhan Mantri Kisan Maandhan Yojna (PM-KMY): For small and marginal farmers who own less than 2 hectares of land.

- National Pension Scheme for Traders and Self-Employed Persons (NPS-Traders): For small shopkeepers, traders, and self-employed business owners.

All three schemes ensure a monthly pension of ₹3000 after 60 years of age.

Eligibility Criteria for Maandhan Yojna

To apply for the Maandhan Yojna, you must: – Be between 18 to 40 years of age at the time of joining. – Have a valid Aadhaar Card. – Have a savings bank account or a Jan Dhan account. – Belong to the target group (farmers, workers, traders).

How Much Do You Have to Contribute?

The best part about the Maandhan Yojna is that it is a contributory scheme—meaning both you and the government contribute. The contribution is very small and depends on your age. For example:

- If you are 18 years old, you need to contribute just ₹55 per month.

- If you are 30 years old, the contribution is ₹100 per month.

- If you are 40 years old, it goes up to ₹200 per month.

The government contributes the same amount as you do. This means you are not alone—the government walks with you every step until you retire.

Benefits of Maandhan Yojna

- Monthly Pension of ₹3000: After turning 60, you will receive ₹3000 every month for life.

- Family Security: In case of your death, your spouse will receive 50% of the pension.

- Easy Enrollment: You can apply online or visit any CSC (Common Service Centre) to get enrolled.

- Government Support: The government matches your contribution.

Emotional Impact of Maandhan Yojna

Imagine a rickshaw puller who has worked day and night his whole life. At 65, he can no longer pull his rickshaw. Without any pension, he depends on his children or sometimes goes hungry. But with the Maandhan Yojna, he gets ₹3000 every month. Now, he can buy his medicines, eat proper food, and live with dignity.

Or imagine a farmer who spent her life feeding the nation. After 60, she has no land to cultivate and no income. The Maandhan Yojna ensures she doesn’t spend her old age in misery. ₹3000 may not make her rich, but it saves her from poverty.

This scheme is not just about money—it’s about giving respect, hope, and happiness to millions.

How to Apply for Maandhan Yojna

Applying for the Maandhan Yojna is simple:

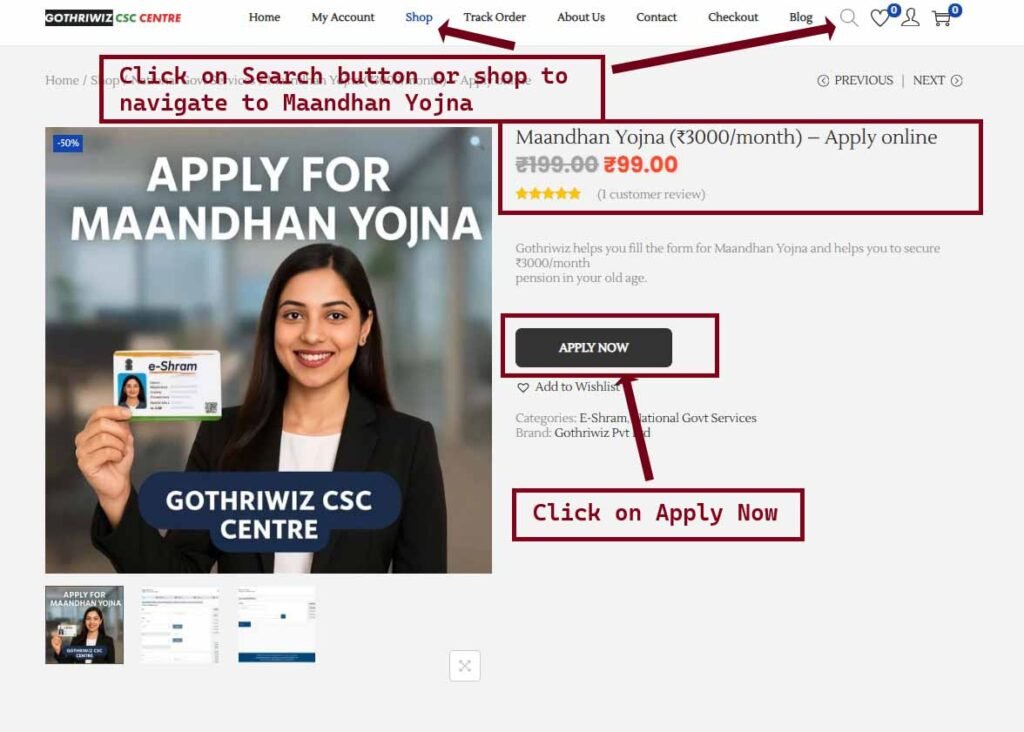

Visit Our Website → Go to gothriwiz.in.

Choose the Service → Select the Maandhan Yojna service from our shop section.

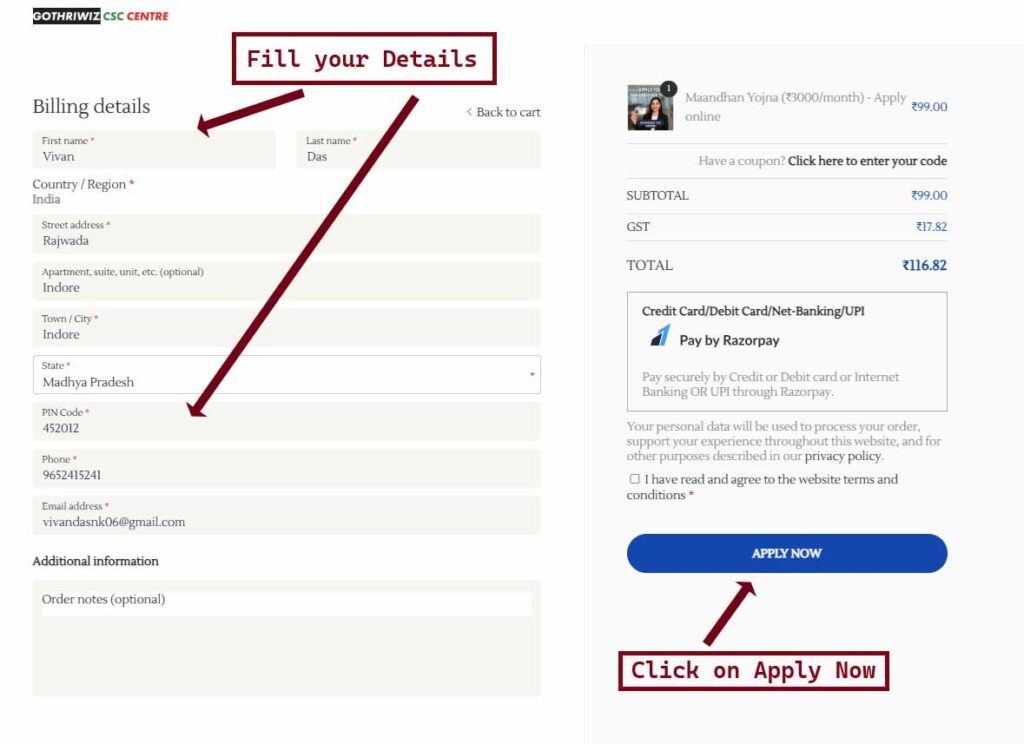

Make the Payment → Complete your payment securely through our checkout page.

We Will Connect With You → After payment, our team will reach out to you directly.

Form Filling Assistance → We will help you fill out and submit the application form correctly.

Get Confirmation → Once the application is submitted, you’ll receive a confirmation of your enrolment.

With this process, you don’t need to run around CSC centres or worry about errors — we take care of everything for you.

Why Every Eligible Person Should Join Maandhan Yojna

Because this scheme is not just a pension—it’s a promise of dignity. Old age should not mean helplessness. With the Maandhan Yojna, the government has taken a strong step towards ensuring that no senior citizen is left hungry or dependent. The scheme ensures financial stability, family support, and above all, peace of mind.

Common Questions About Maandhan Yojna

Q1. Is the pension guaranteed?

Yes. The government provides a monthly allowance of ₹3000 after the age of 60.

Q2. What if I stop contributing in between?

You can revive the account later by paying pending contributions.

Q3. Can I get back my money if I don’t want to continue?

Yes. You can exit early, and the contribution will be refunded in accordance with the rules.

Q4. Is there any tax benefit?

Currently, there are no specific tax benefits under this scheme.

Final Thoughts

The Maandhan Yojna is more than just a pension scheme—it is a message that every life matters. It tells our farmers, traders, and workers: “We value you, we respect you, and we will take care of you when you cannot take care of yourself.”

If you or your loved ones are eligible, do not miss this golden opportunity. A small contribution today ensures a secure, dignified tomorrow. Spread the word. Tell your parents, neighbors, and friends. Because financial security in old age is not a luxury—it is a right.

Visit the Gothriwiz Maandhan Yojna Page and enroll today. Give yourself or your loved ones the gift of dignity and independence with Maandhan Yojna.

Note: Applying for the Maandhan Yojana doesn’t cost you money. But since we are helping you to fill out the form. The cost mentioned is our service fee.