Description

Filing your Income Tax Return (ITR) is more than just a formality—it’s an essential part of your financial responsibility as a citizen. Whether you’re a salaried employee, a freelancer, a shop owner, or a pensioner, filing your ITR keeps you on the right side of the law and can help you claim refunds, secure loans, and maintain clean financial records.

However, the process can feel overwhelming to many people, especially those living in rural areas or those unfamiliar with digital systems. That’s why Gothriwiz CSC Centre in Jharkhand has made it their mission to simplify the process—by offering easy, secure, and accessible ITR filing assistance for all.

What is Gothriwiz CSC Centre?

Gothriwiz CSC Centre is an authorized Common Service Centre (CSC) operating under the Digital India initiative. Based in Palamu district of Jharkhand, this centre connects ordinary citizens with essential online government services—including PAN Card applications, voter ID support, credit card assistance, and more.

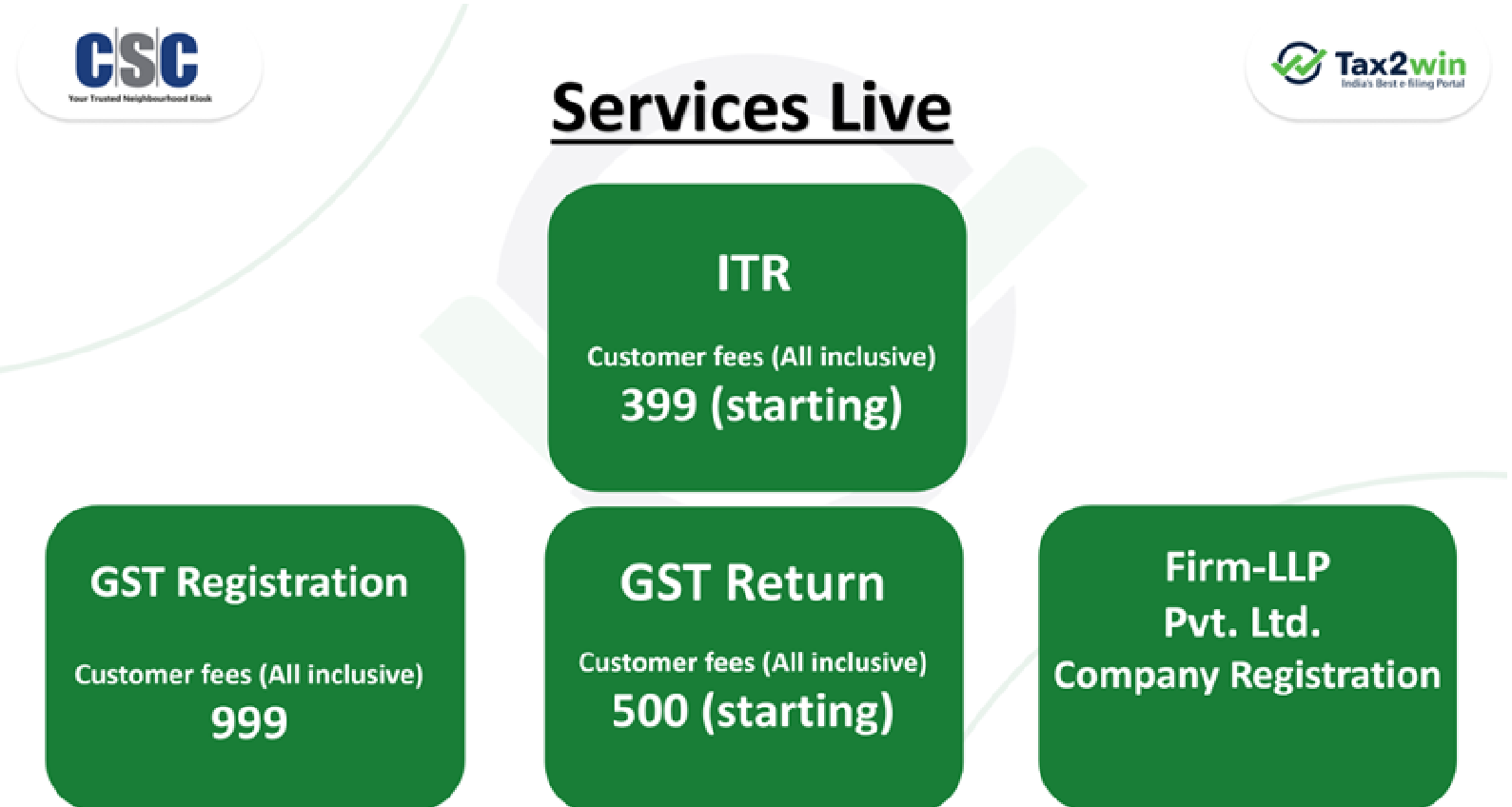

But when it comes to ITR filing, Gothriwiz offers something unique and user-friendly: they collect your data and documents and forward it to TAX2WIN, a registered CA firm. The expert tax professionals at TAX2WIN then handle the actual filing process.

This two-step model ensures that you get expert-verified tax returns without having to navigate complex portals or risk costly mistakes.

How the Process Works

Filing your ITR through Gothriwiz CSC is simple and worry-free. Here’s how it works:

- Visit the Gothriwiz website and select the ITR data collection service.

- Pay a nominal service charge through the website’s secure payment system.

- Submit your documents using a secure Google Form provided to you.

- Gothriwiz forwards your documents to TAX2WIN’s team of Chartered Accountants.

- TAX2WIN prepares and files your return after reviewing your details.

- Once filed, your service charge is refunded to you via your preferred payment method.

- You receive your official acknowledgment copy (ITR-V) via email or WhatsApp.

Why You Should File Your ITR

Filing your return is not just for high earners or businesses. Here’s why every eligible taxpayer should file on time:

- It’s legally required if your income crosses the taxable threshold.

- It allows you to claim TDS refunds if extra tax was deducted.

- It’s required while applying for loans or visas.

- It helps carry forward losses (business or capital).

- It prevents late penalties and compliance notices.

With Gothriwiz, you don’t need to worry about the technical side of it—just submit your documents and let the professionals handle the rest.

Documents Required

To get started with your ITR filing through Gothriwiz CSC, you’ll need the following documents:

- PAN Card

- Aadhaar Card

- Form 16 (if salaried)- we will provide

- Bank passbook or statement

- Rent receipts (if applicable)

- Investment proofs (LIC, PPF, tuition fees, etc.)

- Loan interest certificates

- Business income details or freelance invoices (if applicable)

You’ll be guided by the Gothriwiz team in case anything is missing. We also offer screen sharing support to walk you through every step if needed.

Who Can Use This Service?

This ITR filing assistance is not limited to Jharkhand residents. Since it’s an online service, anyone across India can use it, including:

- Salaried employees

- Freelancers and self-employed professionals

- Shopkeepers and small business owners

- Retired individuals and pensioners

- Students with part-time income

- Homemakers with rental income or investments

Even if it’s your first time filing an ITR, the Gothriwiz support team will ensure the process is smooth and stress-free.

Refundable Charges – A Risk-Free Service

One of the best parts about using Gothriwiz CSC for ITR help is that the service fee you pay is refunded after your return is successfully filed through TAX2WIN.

This refund policy ensures that:

- You don’t have to worry about wasting money.

- You get peace of mind that professionals handled your filing.

- You only pay if the return is filed.

This makes Gothriwiz one of the most affordable and trustworthy options for tax filing assistance in India.

Safe & Secure Process

Your privacy is taken seriously. All your documents are submitted through encrypted links, and Gothriwiz only shares the data with TAX2WIN, which is a trusted CA firm. No third parties are involved, and all communication is kept confidential.

Plus, if you ever feel stuck, the Gothriwiz team is just a WhatsApp message away. Whether it’s help with document uploads or general queries, they’re ready to assist you.

Final Thoughts

ITR filing doesn’t have to be stressful, expensive, or confusing. With Gothriwiz CSC Centre as your partner, you can experience a seamless process where:

- You submit your data securely

- A certified CA files your return via TAX2WIN

- You get your service fee refunded

- And all of it is done from your mobile or computer

It’s safe, fast, professional—and made especially for people who want peace of mind during tax season.

So, if you’re ready to file your ITR this year, start

Reviews

There are no reviews yet.